Stock trading is a complex endeavour that relies heavily on accurate and timely information. One crucial piece of data that traders consistently used to make informed decisions is the Last Traded Price. The LTP reflects the most recent price at which a stock was bought or sold. Understanding and utilising LTP can significantly enhance trading strategies and outcomes. This article explores the multifaceted role of LTP in stock trading.

Calculator For LTP: A Useful Tool

An LTP calculator is a tool that helps traders quickly calculate the last traded price of a stock. Once traders undergo the LTP calculator download process, they can ensure they are working with the most accurate and current price data. This accuracy can prevent costly mistakes that arise from outdated information and enhance the precision of trading strategies. Furthermore, they can be integrated into trading platforms, providing real-time updates and automated calculations, which streamline the trading process and reduce the likelihood of errors.

Importance of Real-Time Data

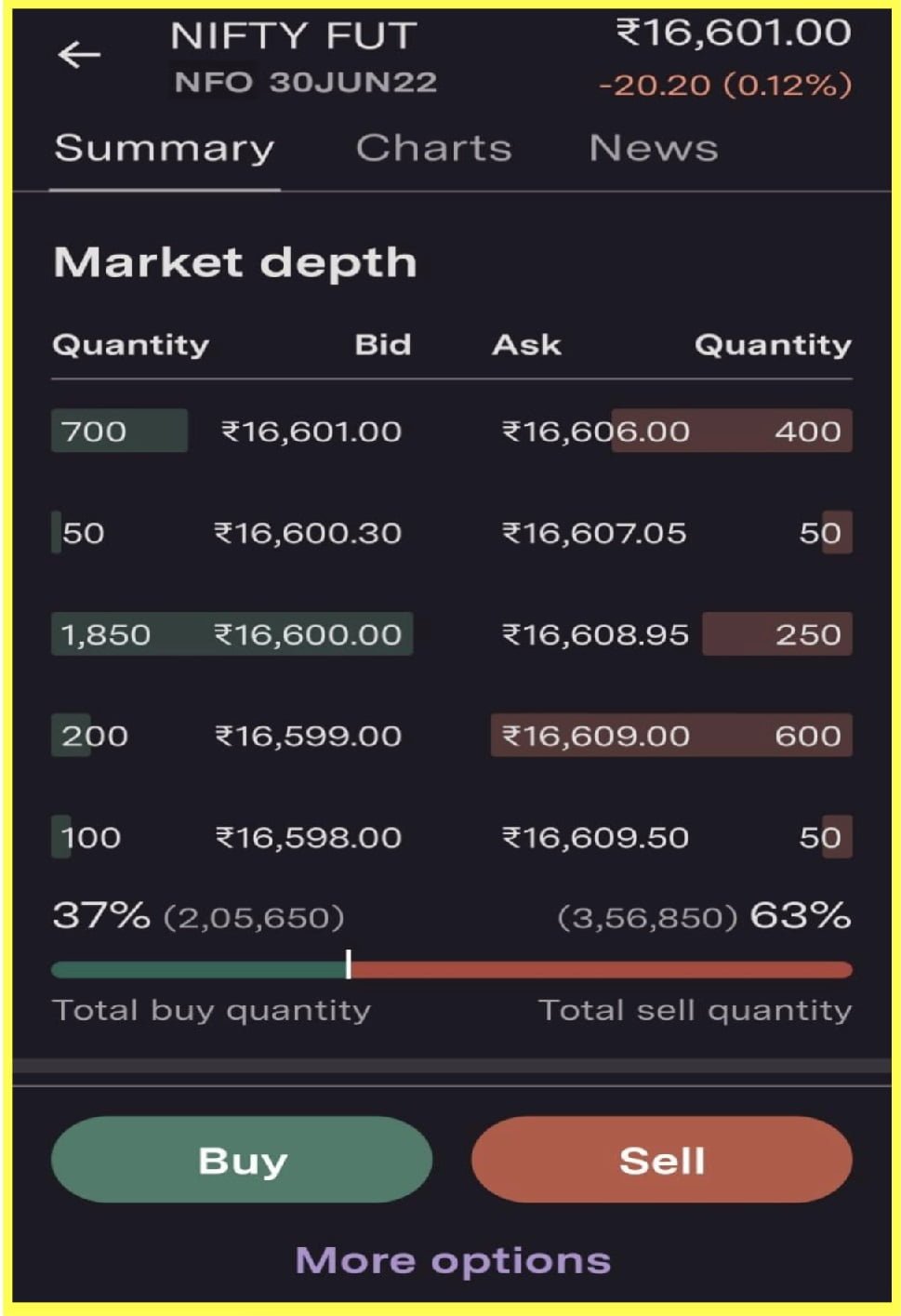

It provides traders with the most up-to-date information on a stock’s price. This real-time data is crucial for quick decisions, especially in volatile markets. When traders see the LTP, they know the exact price at which the last trade occurred, enabling them to gauge market trends and investor sentiment. This immediate insight can lead to more precise entry and exit points in trading strategies. With access to the latest price data, traders can adjust their positions accordingly, capitalise on short-term opportunities, and minimise potential losses.

LTP and Market Sentiment

It is a direct reflection of market sentiment at any given moment. It shows the price at which buyers and sellers have agreed, indicating the current demand and supply dynamics. A rising LTP can signal increasing demand and positive sentiment, while a falling one may suggest the opposite. By closely monitoring movements, traders can infer whether a stock is gaining or losing favour in the market, allowing them to align their trades with the prevailing sentiment. Understanding market sentiment through LTP can also help traders anticipate potential price movements and make more informed predictions about future trends.

Using LTP in Technical Analysis

Technical analysis involves studying past market data to predict future price movements. It is a critical component of this analysis. Traders use it along with historical price data to identify patterns and trends. For instance, it can help determine support and resistance levels and key technical analysis concepts. Support levels are prices at which a stock tends to stop falling, while resistance levels are prices at which a stock tends to stop rising. Understanding these levels through LTP analysis can help traders better predict future price movements. Moreover, incorporating LTP into technical indicators and chart patterns can enhance the accuracy of trading signals and improve overall trading performance.

Enhancing Decision-Making with LTP

The ability to make swift and informed decisions is essential in stock trading. LTP aids in this by providing a clear snapshot of the market’s latest activity. When traders can access the most recent trade prices, they can more accurately assess their potential risks and rewards. Additionally, LTP can serve as a benchmark for comparing the performance of different stocks, helping traders identify the best market opportunities. By continuously monitoring LTP, traders can stay ahead of market trends, adjust their strategies in real time, and make well-informed decisions that align with their trading goals and risk tolerance.

The Last Traded Price (LTP) is vital information for stock traders. It offers real-time insights into market sentiment and enhances decision-making processes. With an LTP calculator download, traders can further improve the accuracy and efficiency of trading strategies. Ultimately, integrating LTP into trading practices can lead to more successful and profitable trading outcomes.