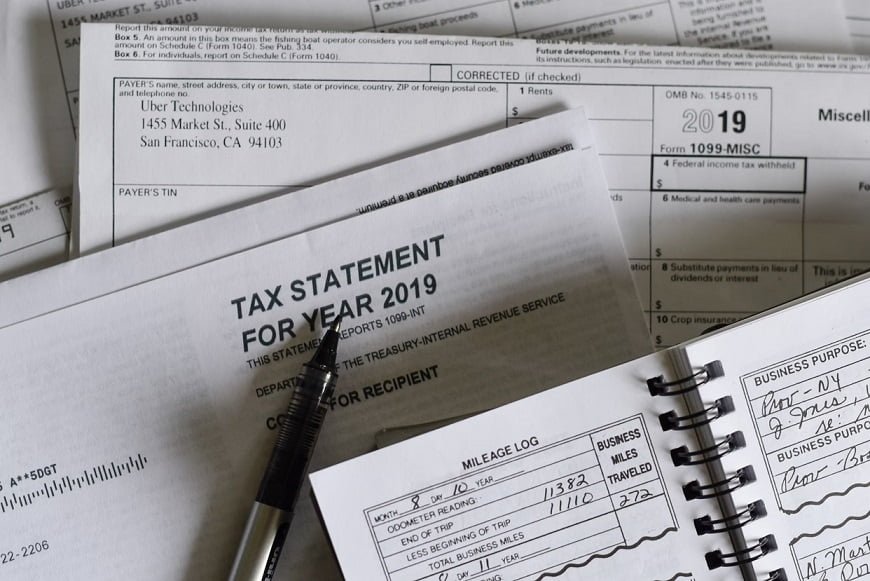

Tax season is often a difficult time of year, full of complexity and worry. It’s essential to file your taxes accurately in order to minimize fines and take advantage of any available deductions. This article examines five strong justifications for hiring a professional during tax season. Professional help can make a big difference for a variety of reasons, including managing complex tax circumstances and optimizing deductions, preventing mistakes, managing time, and remaining current with tax legislation. By being aware of these advantages, you may make your tax return precise and maximized while navigating tax season more skillfully and efficiently.

Complex Tax Situations

It can be difficult to navigate complicated tax situations, particularly for people who manage investments, have multiple sources of income, or work for themselves. These conditions make filing taxes much more difficult and necessitate a detailed knowledge of tax laws and regulations. Tax specialists possess specialized knowledge to handle these intricacies efficiently. They are skilled in managing complex issues like capital gains, company expenses, and other financial nuances that can be too much for the typical taxpayer to handle. Hiring a professional ensures compliance with tax regulations and reduces the possibility of expensive mistakes. Additionally, they adeptly recognize chances to optimize deductions, which may result in financial savings for you. During tax season, this proactive approach not only minimizes risks but also maximizes your financial results.

Maximizing Credits and Minimizing Deductions

Effectively reducing your tax burden requires making the most of your credits and deductions. Tax professionals are well-versed in the different deductions and credits available, which include those for education, home office expenses, and energy-efficient home modifications. They are particularly good at spotting possibilities that are easily missed, such as retirement contributions, medical bills, and charitable deductions. Experts make sure that all applicable credits and deductions are used by performing a comprehensive evaluation of your financial status and optimizing your possible savings. Hiring an expert can improve accuracy and maximize your tax plan, which could result in significant cost savings. Tax relief services can provide the expertise needed to navigate complex tax laws and ensure you receive all the benefits you’re entitled to. By taking this proactive stance, you may make the most of all possible tax benefits and secure a better financial outcome come tax season.

Avoiding Errors and Audits

Making sure your tax return is accurate is essential to avoiding fines, hold-ups in the processing, and even audits. Errors can have expensive repercussions, such as insufficient or erroneous information, calculations, or income reports. In order to guarantee that your return is accurate and comprehensive, getting help from tax professionals is essential. They thoroughly check all calculations and entries, greatly lowering the possibility of mistakes. Moreover, by spotting and resolving any red flags that can draw IRS attention, their experience lessens the chance of starting an audit. By taking preventative measures, you may protect your financial stability and ease your mind during tax season, freeing you up to concentrate on other important matters, free from the worry of possible tax-related complications.

Time and Stress Management

It can be difficult and time-consuming to prepare your taxes since you have to gather paperwork, understand tax regulations, and carefully fill out forms. It takes a lot of time and work to complete this procedure. Hiring a tax expert is a way to reduce stress and save time. Experts handle every facet of tax preparation, allowing you to concentrate on other important duties. They expedite the procedure, guaranteeing accuracy and efficiency in processing your return. You may avoid the stress of tax season and save a lot of time by leaving your taxes to the professionals. You may handle your tax duties with ease and without the usual stress and hassle when you know that a skilled professional is managing your tax issues.

Staying Updated with Tax Laws

Being knowledgeable on tax rules and regulations is challenging for the average person because they are always changing. The comprehension and maintenance of these developments are the focus of the professions of tax professionals. They participate in continuing education, attend seminars, and stay up to date on industry developments. This current information is essential for proper and beneficial tax filing. Working with a professional gives you access to their knowledge and up-to-date comprehension of tax legislation. They can apply recently discovered credits and deductions that you may not be aware of, making sure you don’t lose out on any possible savings. When you trust an expert, you can be sure that your tax return is accurate and provides peace of mind.

Conclusion

It doesn’t have to be difficult or stressful to get through tax season. You may optimize your deductions, avoid costly mistakes, and save a significant amount of time by getting professional assistance. Experts maintain current knowledge of tax legislation, guaranteeing your return is precise and complies with regulations. The investment is well worth it because of their knowledge and assurance. This tax season, think about contacting a tax expert to make sure your taxes are done properly and free up your time for other essential facets of your life.

Read More: Understanding the Kennedy Funding Lawsuit: What You Need to Know